On the First 35000 Next 15000. For chargeable income in excess of MYR 500000 the corporate income tax rate is 25.

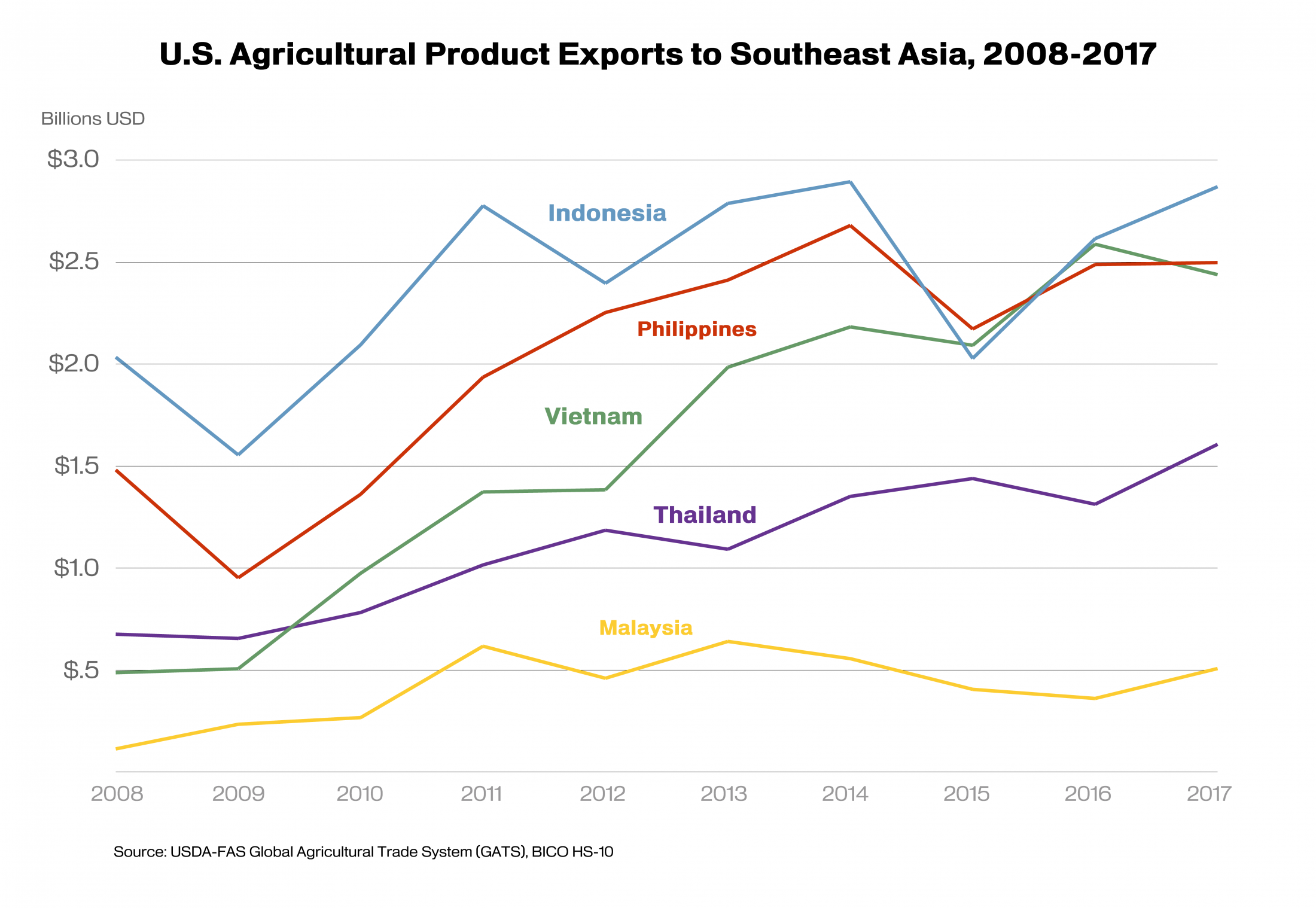

Trade Opportunities In Southeast Asia Indonesia Malaysia And The Philippines Usda Foreign Agricultural Service

Tax RM 0 2500.

. To increase the disposable income of middle-income taxpayers and address the rising cost of living the 2018 budget would reduce individual income tax rates for resident individuals by 2 for three of the chargeable income bands ranging from MYR 20001 to MYR 70000 as follows. An effective petroleum income tax rate of 25 applies on income from petroleum operations in marginal fields. The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2.

The relevant proposals from an individual tax perspective are summarized below. Under the current legislation the income tax structure for resident individuals is based on progressive tax rates ranging from 0 to 28 on chargeable income. Starting from year of assessment 2017 the lifestyle tax relief includes individual with a monthly income of RM3600 and above said Choong Hui Yan a tax consultant from SIMways.

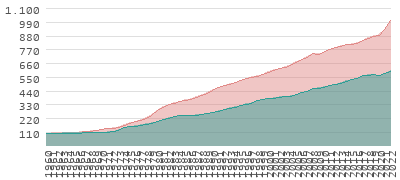

Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28. On the First 5000. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Malaysia individual tax rate 2017 The amount of tax relief 2017 is determined according to governments graduated scale. The Malaysian 2020 budget raised the maximum tax rate an individual could pay to 30 percent from 28 percent for chargeable income exceeding 2 million ringgit US489 thousand. Nonresident individuals are taxed at a flat rate of 28.

Year 2017 USA Malaysia USA Malaysia USA 59 days 122 days 31 days 61 days 92 days 306201 7. 13 rows 2000000. These will be relevant for filing personal income tax 2018 in malaysia.

For expatriates that qualify for tax residency Malaysia has a progressive personal income tax system in which the tax rate increases as an individuals income increases. 2017 law versus 2018 tax reform tax reform rate cuts. This means that low-income earners are imposed with a lower tax rate compared to those with a higher income.

On the First 5000 Next 15000. Corporate income tax CIT due dates. A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity.

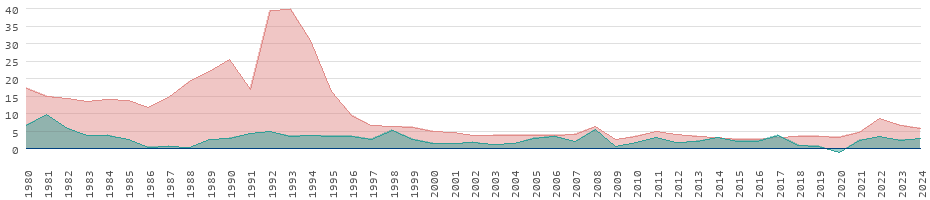

Reduction of certain individual income tax rates. Malaysia adopts a territorial principle of taxation meaning only incomes. Detailed description of significant developments in individual taxation in Malaysia Quick Charts Back.

No other taxes are imposed on income from petroleum operations. 15 percent and 28 percent. Lets take into account.

However taxable income over certain levels was subject to a 33-percent tax rate to phase out the benefit of the 15-percent tax bracket as compared to the 28-percent rate and the deduction for personal exemptions. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so. On the First 50000 Next 20000.

The new lifestyle tax is not exactly new. Individual Income Tax Rates 2017 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates. On the First 5000 Next 15000.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. Child care fees to a Child Care Centre or a Kindergarten. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards.

There are no other local state or provincial government taxes. Leasing income from moveable property derived by a permanent establishment in Malaysia is taxed against a rate of 25 whereas a non-resident corporation with no Malaysian permanent establishment is taxed against a rate of 10. On the First 70000 Next 30000.

Interest expended to finance purchase of residential property. Taxpayers only pay the higher rate on the. Rate TaxRM A.

Corporate income tax CIT rates. On the First 2500. Singapore To Impose New Individual Income Tax Rates In 2017 Asean Business News Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

Nonresident individuals are taxed at a flat rate of 28. The system is thus based on the taxpayers ability to pay. Americans who filed an extension on their taxes this year will want to take a look at the federal governments 2020 tax brackets.

Period of Stay in Malaysia Number of Days 132017 - 3062017 122 183 182017 - 3092017 61 61 The situation is summarized as follows. Calculations RM Rate. Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system.

Other rates are applicable to. 24 rows Net saving in SSPNs scheme total deposit in year 2017 MINUS total withdrawal in year 2017 6000 Limited 11. On the First 20000 Next 15000.

Malaysia Personal Income Tax Rate. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020. In 2018 some individual tax rates have been slashed 2 for three slabs Chargeable Income Bands 20001-35000 35001 50000 50001 -70000 will now be taxed 3 8 14 respectively.

You can check on the tax rate accordingly with your taxable income per annum below. Relief of up to RM10000 a year for three consecutive years from the first year the interest is paid. A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020.

Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Introduction To Fxfactory User Manual Pinterest Final Cut Pro

Epic Research Singapore Weekly Iforex Singapore Report Of 04 08 M Financial Advisory Reading Charts Forex Signals

Awesome Our Life In Singapore Have You Been To Kusu Island Photo Kusu Island Kusu Island Pinterest Photos Singapore And Our Life

In Indonesia About Half Of Adults Are Underbanked Meaning They Don T Have Access To Bank Acc Life Skills Special Education Social Stories Preschool Edutech

Department Of Statistics Malaysia Official Portal

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Minimum Wages Order 2022 Gazetted Donovan Ho

Esos What You Need To Declare When Filing Your Income Tax

Malaysia Corporate Income Tax Rate Tax In Malaysia

Malaysia Corporate Income Tax Rate Tax In Malaysia

Malaysian Telcos Offer Free Internet Access For Learning Productivity